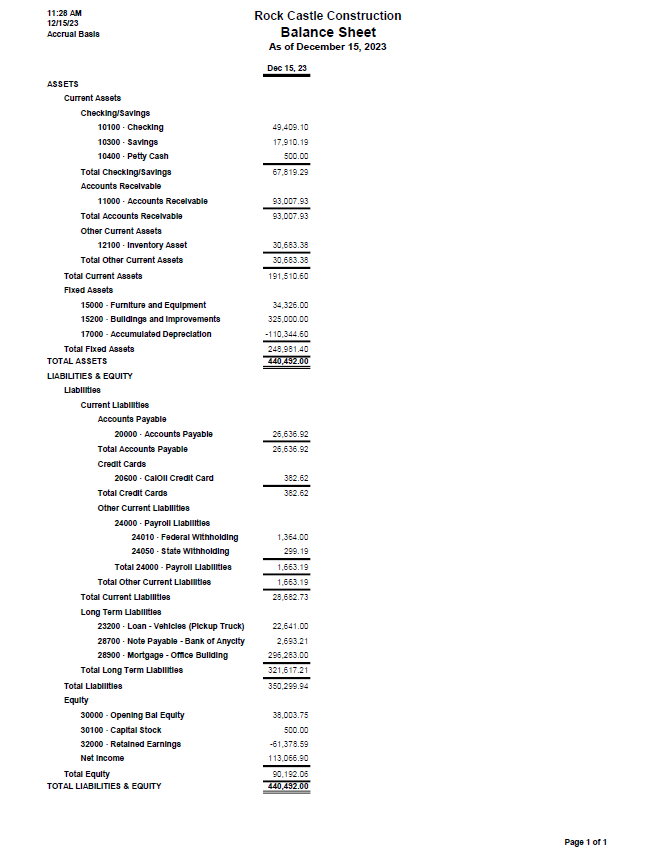

Some people are intimidated by financial statements and do not understand how to read them. Although it might look confusing, it is critical you review your businesses financials, as they tell you what is going on with your business. A Balance Sheet is very important because it lists out all of your Assets, Liabilities and Equity as of a certain date, normally the last day of the month. Everything in accounting must equal, therefore assets = liabilities + equity.

Let’s go into detail for each of the categories.

Assets include:

Cash – How much money your bank accounts have in them.

Accounts Receivable – The amount of money you are owed from other people.

Inventory – If you sell product, the amount of inventory you have on hand.

Equipment – If you purchase expensive equipment and plan to depreciate it.

You can have current & fixed assets. Current assets are short term, for example cash. Fixed assets are long term, for example equipment.

Liabilities include:

Accounts Payable – The amount of money you owe other people.

Credit Cards – The amounts you have put on your credit card but have not paid yet.

Payroll Liabilities – This is the payroll taxes you owe after you run payroll, but have not paid yet.

Loans – You can have short-term loans like a line of credit. Or long-term loans like a mortgage.

You can have either current or long-term liabilities. Current liabilities are short term, for example accounts payable and credit cards. Long-term liabilities are long term, for example loans.

Owner’s Equity includes:

Owners Investment – The amount an owner has put into the business.

Stock – The amount owners have bought into the company.

Retained Earnings – The cumulative total of previous year’s net income or loss.

Net Income – How profitable the business has been for the fiscal year.

Below is an example of a Balance Sheet, of course there can be other items included on the balance sheet that was not discussed above or shown below. Give CFO 4 Your Biz a call if you need someone to prepare your financial statements for you or if you have questions about your balance sheet at 402-216-0356. When you work with CFO 4 Your Biz you can ask unlimited questions and we make sure you understand the Financial Statements we give you.